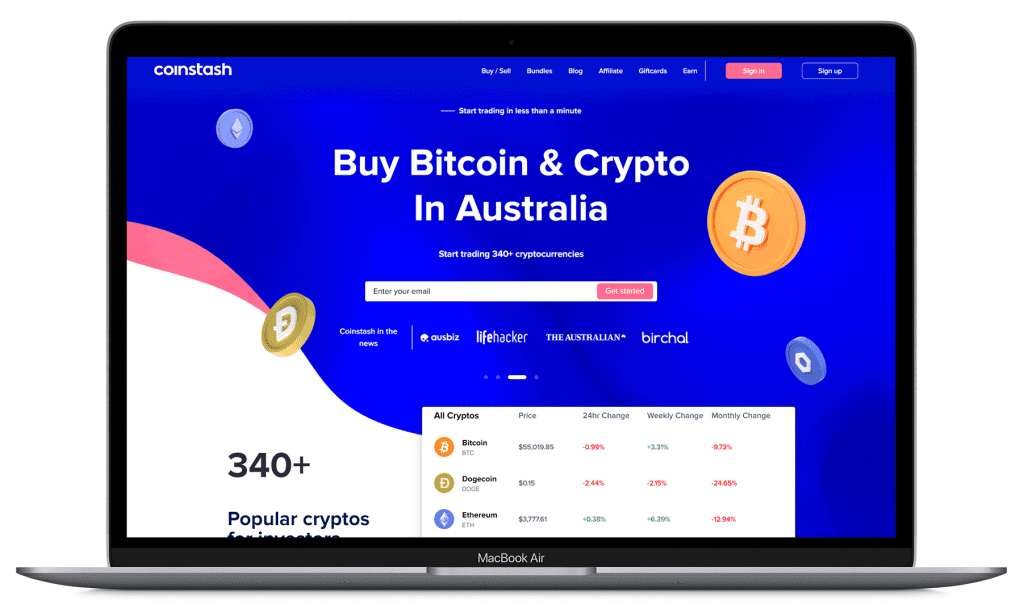

Founded in 2018, Brisbane-based Coinstash is one the newer cryptocurrency exchanges to bounce into the Australian market.

Led by a youthful management team and backed by some big ideas, it didn’t take long for Coinstash to begin causing a stir among local punters.

Since launching the platform has maintained a steady trend of upwards growth, and as of 2022 has reportedly reached a valuation of more than AUD $20 million. Not bad for a few years work.

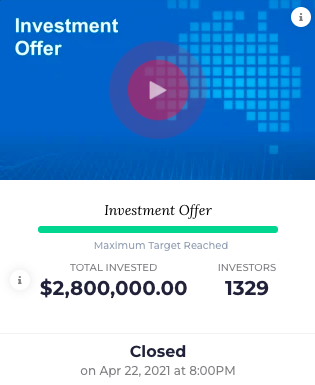

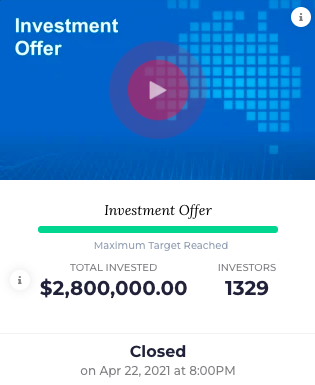

This is even more impressive when considering that Coinstash really only had their first big breakout back in April 2021, with the successful closure of a $2.8 million equity crowdfunding campaign.

Hosted on Sydney-based CSF platform Birchal with the support of us here at Glide on marketing duty, Coinstash’s equity raise was the first of many big steps for the young startup.

Like any startup chasing after the next big idea, Coinstash centered their ethos around an opportunity had been left undetected – or ignored – by most of their competition.

Realising that Australia didn’t need another standard crypto exchange, Coinstash were determined to become more than just that.

Their mission? To normalise the use of crypto as a viable form of value.

The idea? Their platform would, eventually, allow people to;

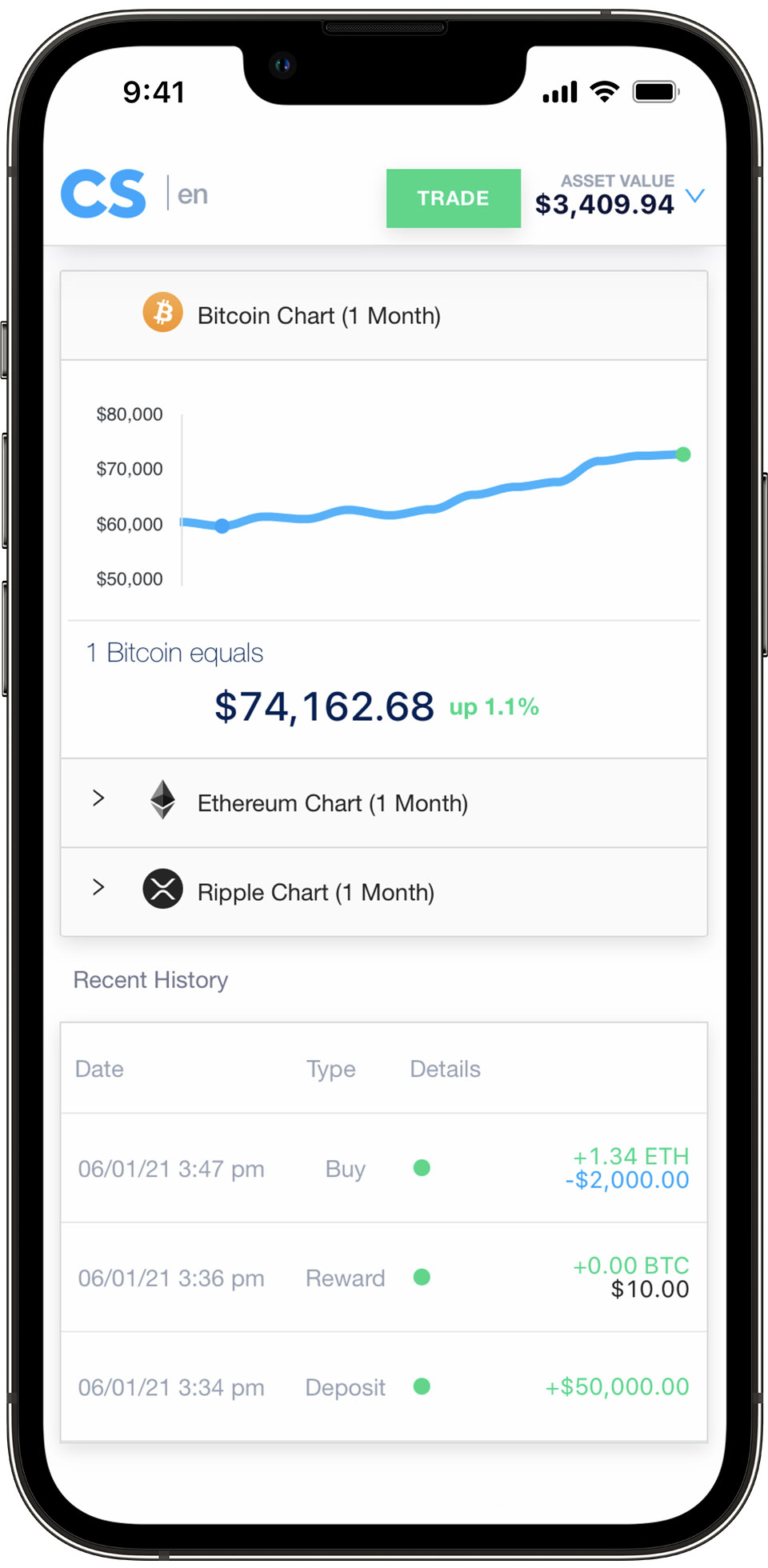

- Earn interest on their crypto holdings

- Spend their coins directly via special credit cards

- Borrow money against their crypto holdings as collateral

It was these aspirational ideas that turned Coinstash from another standard exchange platform into a project that was actually worth some excitement.

But big ideas mean nothing if you can’t follow up with them, and so Coinstash turned, like many other idealists before them, to equity crowdfunding, hoping to acquire the capital they’d need to get themselves properly up and running.

In collaboration with ECF market leader Birchal, Coinstash enlisted us at Glide to handle their digital marketing efforts for what would turn out to be our second most valuable equity raise to-date.

There’s no equation to guarantee a successful crowdfunding campaign, but one thing you can’t overlook is a valid proof of concept.

With several thousand users already trading on their platform, Coinstash already had utility, lifting them out of that nightmarish startup stage of ‘ideas with nothing to show for it’.

This was a good start, but compared to other Australian exchanges like Coinspot, a few thousand users wasn’t a very convincing selling point.

Fortunately, luck was on their side.

By this point of 2021, the world was in the middle of cryptocurrency mania. No matter where you went, it was everywhere.

Like Lazarus, Bitcoin had risen from the dead, surging to a value of more than $80,000 in a manner of months.

In a matter of weeks, the financial world was flipped on its head. News coverage intensified, social media went bezerk, Elon Musk got involved, Twitter was moving markets and people were going crazy about a dog on a coin.

It was complete madness. The last thing I can remember causing this much hype was Planking, and everyone wanted a piece of the action.

Of course, to buy crypto you need an exchange – and it just so happened we knew where to find one.

In response to all of this excitement, Coinstash’s modest user base seemed to grow irrelevant overnight.

What they were doing didn’t seem to matter anymore, but what they might do was an entirely different story.

This context, and the shift in public perception that came with it, shaped not only our marketing campaigns, but likely much of the final outcome as well.

Building a campaign on the back of such a massive buzz comes with its own unique set of challenges.

While the context was, for the time being, on our side, it was important to remember that this wasn’t a component of our campaign, merely a bonus.

One byproduct of this mass hysteria was an opportunity to attract a much wider range of audiences to Coinstash’s offer, improving our potential reach significantly.

With more people in our crosshairs, this meant we could spend time building more practical, personalised messaging to cover our bases.

For example, where crypto enthusiasts would see copy espousing de-centralisation and Coinstash’s vision for the market, average retail investors would instead see messaging centered around market size, company growth and financial potential.

This personalisation is an important feature of any CSF campaign, and helps to avoid any risk of leaving potential investors uninterested.

In this case, more messaging meant a lot more care was needed to avoid stepping too far into the legal gray zone where Coinstash resided.

With much of the company’s value – real or otherwise – resting on a mix of unapproved ideas and market speculation, we had to be cautious with our use of language.

Regardless who we were speaking to, each bit of copy included several key themes to cover all our bases evenly, without risking scrutiny – legal or otherwise;

- Their motivations (improved financial freedom)

- Their vision for the future (greater crypto utility)

- Their potential (market size, lack of competitive innovation)

- Their risk (asset speculation, market dependence)

Pairing honest, forward-thinking copy that left little room for criticism with a professional pitch deck and vibrant assets, we charted a course that steered Coinstash to a total of more than 1,800 Expressions of Interest.

All we needed to do then was make sure those prospects came good on their promises.

Coming off the back of a strong but speculative EOI period, it didn’t take long for Coinstash to start seeing the investment numbers bumping up.

In the space of just six hours, the tally had already passed $1 million, blasting their minimum out of the park!

By the end of the four week investment period, the Coinstash crew could breathe a sigh of relief, hitting their $2.8 million max target with only a few days to spare.

Welcoming 1,329 new shareholders on board for the next phase of their journey, Coinstash remain to this day our second most successful ECF partnership – a happy outcome for all.

Writing this in March 2022, it becomes clear just how much things have changed in the last 10 months since the offer closed.

After a year of increased scrutiny from global regulators, mass mining bans & boycotts, market manipulation, Dogecoin dilemmas and a mass exodus of amateur investors, the cryptocurrency industry has certainly seen better days.

But despite this, those who weathered the storm – like Coinstash – still remain.

Why? Because at its core, cryptocurrency is and always has been about more than just coins.

Coinstash was founded on this understanding, and an honest belief in the ideas at the heart of cryptocurrency – de-centralisation, blockchain technology and the prospect of financial revolution – continues to drive them today.

Whatever they do and wherever they go from here, their campaign remains to this day one of the most intriguing, exciting raises we’ve had the pleasure of handling.

Whether or not it was a success, we’ll just have to wait and see.